Investment for startups is a vital element of the entrepreneurial adventure, serving because the lifeblood that allows cutting edge concepts to develop into into viable companies. Working out the various forms of investment to be had, together with bootstrapping, angel making an investment, undertaking capital, crowdfunding, and grants, is very important for aspiring marketers. Each and every investment street items distinctive alternatives and demanding situations that may considerably affect the trajectory of a startup.

This dialogue delves into the intricacies of startup investment, offering a complete evaluate of preparation, investor engagement, felony concerns, and prevailing developments within the investment panorama.

Sorts of Investment for Startups

Startups face more than a few monetary demanding situations, and working out the forms of investment to be had is an important for his or her survival and expansion. Other investment choices can considerably affect the trajectory of a industry. This segment Artikels the main investment mechanisms, highlighting their traits, benefits, disadvantages, and real-life examples of startups that effectively leveraged each and every manner.

Bootstrapping

Bootstrapping refers back to the observe of establishing a industry the use of private financial savings or earnings generated from the operation itself. This technique lets in marketers to deal with complete keep watch over over their companies with out exterior interference.

- Instance: Mailchimp, the e-mail advertising carrier, began with bootstrapped investment, permitting its founders to retain possession and develop organically.

- Benefits: Complete keep watch over, no debt, and independence from exterior buyers.

- Disadvantages: Restricted sources, slower expansion prospective, and better private monetary possibility.

Angel Making an investment

Angel making an investment comes to prosperous people offering capital for startups in change for possession fairness or convertible debt. Angels ceaselessly be offering no longer simply price range, but in addition mentorship and treasured {industry} connections.

- Instance: Google won early-stage financing from angel investor Ron Conway, which helped propel its expansion.

- Benefits: Get entry to to mentorship, much less formal than undertaking capital, and quicker investment procedure.

- Disadvantages: Attainable lack of fairness, reliance on person buyers’ selections, and variable ranges of investor involvement.

Project Capital

Project capital (VC) is a type of personal fairness financing devoted to early-stage, high-potential expansion corporations. VC corporations organize pooled price range from many buyers to spend money on startups.

- Instance: Fb’s early investment got here from undertaking capital company Accel Companions, which performed a an important function in its speedy growth.

- Benefits: Vital capital, skilled steering, and {industry} connections.

- Disadvantages: Prime expectancies for speedy expansion, power to accomplish, and prospective lack of keep watch over over industry selections.

Crowdfunding

Crowdfunding lets in startups to lift small quantities of cash from numerous other people, usually by way of on-line platforms. This technique can validate a industry concept whilst producing essential price range.

- Instance: Pebble Era raised over $10 million thru Kickstarter for its smartwatch, proving the efficacy of crowdfunding.

- Benefits: Get entry to to price range with out giving up fairness, marketplace validation, and neighborhood engagement.

- Disadvantages: Time-consuming marketing campaign setup, prospective for failure to succeed in investment targets, and public publicity to industry concepts.

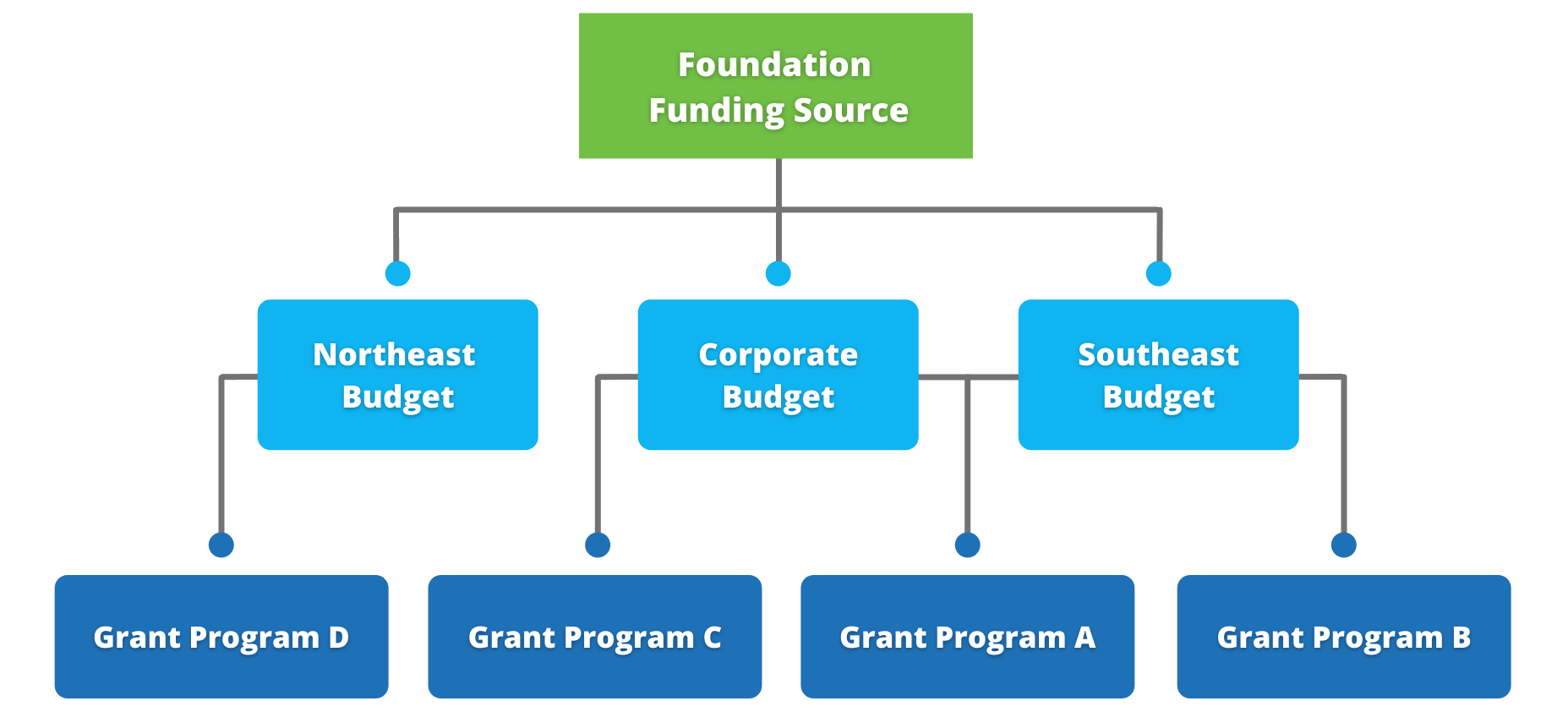

Grants

Grants are price range supplied via governments, firms, or foundations that don’t require reimbursement. Those are usually aimed toward fostering innovation and entrepreneurship in particular sectors.

- Instance: The Nationwide Science Basis gives grants for tech startups that meet particular standards, serving to them to innovate with out the load of reimbursement.

- Benefits: Non-dilutive capital, no reimbursement duties, and prospective status.

- Disadvantages: Extremely aggressive, ceaselessly calls for rigorous reporting and compliance, and restricted investment quantities.

Making ready for Investment Packages

Securing investment calls for a well-thought-out technique and meticulous preparation. Startups should display their viability to prospective buyers and articulate their industry imaginative and prescient obviously. This segment Artikels the vital steps to arrange for investment packages, highlighting the significance of commercial plans and efficient pitching tactics.

Making a Trade Plan

A forged marketing strategy serves because the blueprint for any startup in the hunt for investment. It will have to obviously Artikel the industry fashion, marketplace research, and detailed monetary projections.

- Come with government summaries that keep up a correspondence the original price proposition.

- Supply thorough marketplace analysis that identifies goal consumers and competition.

- Provide detailed monetary projections, together with earnings forecasts and break-even research.

Presenting a Pitch, Investment for startups

The pitch to prospective buyers is a vital element of the investment procedure. Startups will have to focal point on readability, conciseness, and engagement all through their shows.

- Make the most of visible aids to reinforce and improve verbal conversation.

- Apply handing over the pitch to refine the message and look forward to questions.

- Spotlight milestones completed and long run targets to construct credibility.

Commonplace Errors to Keep away from

Navigating the investment panorama will also be difficult, and startups will have to pay attention to not unusual pitfalls that may undermine their efforts.

- Failing to investigate prospective buyers completely, resulting in misalignment.

- Deficient monetary projections that lack realism or element.

- Neglecting to apply up with buyers after the preliminary pitch.

Discovering Traders

Figuring out and concentrated on the precise buyers is an important for startups. Efficient methods can facilitate significant connections and build up the possibilities of securing investment. This segment discusses more than a few approaches to discovering buyers, in addition to sources to lend a hand within the seek.

Efficient Methods

Startups will have to make use of strategic tips on how to determine prospective buyers who align with their imaginative and prescient and {industry}.

- Networking inside of industry-specific occasions and meetings to fulfill buyers face-to-face.

- Using on-line platforms like LinkedIn to connect to prospective buyers.

- Attractive with native entrepreneurial communities and undertaking capital teams.

Assets and Gear

A lot of sources and gear can assist facilitate connections between startups and buyers.

- AngelList, a platform that connects startups with angel buyers.

- Crunchbase, which gives complete knowledge on more than a few buyers and investment rounds.

- SeedInvest, a crowdfunding platform that permits startups to lift capital from permitted buyers.

Networking Occasions and Platforms

Attending networking occasions and using platforms devoted to investment can improve startups’ visibility amongst buyers.

- Startup Grind, an international neighborhood of startups, founders, and buyers.

- TechCrunch Disrupt, an annual convention interested by era startups and investment.

- Meetup teams targeted round entrepreneurship and funding alternatives.

Managing Investor Relationships

Development and keeping up wholesome relationships with buyers post-funding is very important for long-term luck. This segment emphasizes the significance of conversation and managing expectancies.

Significance of Wholesome Relationships

A hit startups acknowledge the worth of fostering robust relationships with their buyers. Those relationships may end up in further investment and reinforce.

- Common updates on corporate growth can make stronger agree with and engagement.

- Encouraging open discussion can assist deal with issues and foster collaboration.

- Involving buyers in strategic selections can improve their dedication to the startup.

Speaking Growth

Efficient conversation is vital to managing investor relationships. Startups will have to identify a constant conversation technique.

- Using newsletters or studies to offer updates on key metrics and milestones.

- Scheduling common conferences to talk about growth and deal with questions.

- Being clear about demanding situations and the way they’re being addressed.

Managing Expectancies

Atmosphere real looking expectancies is an important for keeping up investor self assurance. Startups will have to be proactive in managing prospective issues.

- Obviously keep up a correspondence expansion methods and anticipated timelines.

- Cope with any deviations from deliberate targets with transparency.

- Supply assurance referring to monetary well being and function metrics.

Felony Concerns in Investment

Navigating the felony panorama is prime when securing investment. Startups should pay attention to more than a few felony concerns that may affect their investment adventure. This segment supplies insights into the crucial felony sides related to investment.

Key Felony Facets

Startups will have to familiarize themselves with vital felony concerns when accepting investment to verify compliance and coverage.

- Working out the results of fairness dilution when bringing on buyers.

- Compliance with securities laws to stop felony problems.

- Making sure that every one agreements are obviously Artikeld and agreed upon via all events concerned.

The Significance of Time period Sheets

Time period sheets function initial paperwork outlining the phrases of funding agreements. They’re necessary for surroundings expectancies between startups and buyers.

- Time period sheets element the rights and duties of each events, together with valuation and investment quantities.

- Working out phrases reminiscent of liquidation personal tastes and board keep watch over is an important for startups.

- Making sure readability in time period sheets can save you long run disputes and misunderstandings.

Highbrow Belongings Coverage

Startups should prioritize highbrow assets (IP) coverage, particularly when investment discussions are underway.

- Making sure that every one IP is correctly registered and documented can improve credibility with buyers.

- Carrying out IP audits sooner than coming near buyers can assist determine prospective vulnerabilities.

- Working out how IP rights are handled in investment agreements is very important for protecting inventions.

Tendencies in Startup Investment: Investment For Startups

The startup investment panorama is steadily evolving, influenced via more than a few developments and technological developments. This segment supplies an outline of present developments in startup investment and their implications for marketers.

Present Investment Tendencies

Working out rising developments can assist startups navigate the investment panorama extra successfully.

- The upward thrust of affect making an investment, the place buyers search social and environmental advantages along monetary returns.

- Larger hobby in decentralized finance (DeFi) platforms for fundraising and funding.

- Rising emphasis on sustainability and moral industry practices in investment selections.

Era’s Affect on Investment

Technological developments are reshaping how startups safe investment, introducing new mechanisms and platforms.

- The emergence of blockchain era in streamlining funding processes and adorning transparency.

- Expansion of on-line crowdfunding platforms, enabling startups to succeed in wider audiences.

- Usage of information analytics to spot prospective buyers and tailor pitches successfully.

World Variations in Investment Alternatives

Investment availability can range considerably throughout other areas and markets, influenced via native financial stipulations and regulatory environments.

- Rising markets ceaselessly face demanding situations in gaining access to undertaking capital in comparison to evolved economies.

- Govt incentives and reinforce systems can improve investment alternatives in sure areas.

- Cultural attitudes against entrepreneurship and possibility can affect the willingness of buyers to fund startups.

*Post Disclaimer*

The information Article Funding For Startups no representations or warranties of any kind suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Pitch Perfect is not responsible for user-generated content. We disclaim all liability for posts violating any laws or ethical standards. Users alone bear full responsibility for their submissions. Violations will result in immediate content removal and account restriction without appeal.